Latest News

Several attractive benefits announced under new tax regime: Substantial tax relief to salaried individuals and pensioners

In a move to provide substantial tax relief to salaried individuals and pensioners, Union Finance and Corporate Affairs Minister Nirmala Sitharaman announced several attractive benefits under the new tax regime while presenting the Union Budget 2024-25 in Parliament today.

New Delhi, July 23: In a move to provide substantial tax relief to salaried individuals and pensioners, Union Finance and Corporate Affairs Minister Nirmala Sitharaman announced several attractive benefits under the new tax regime while presenting the Union Budget 2024-25 in Parliament today.

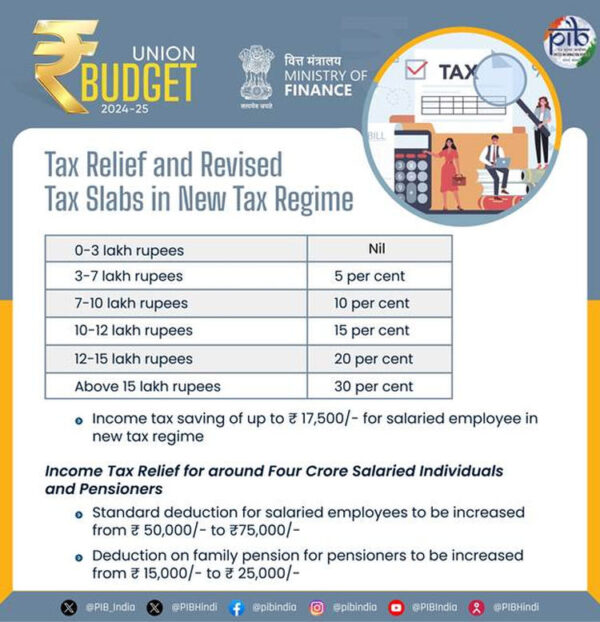

A key feature of the budget is the proposed increase in standard deduction for salaried employees from ₹50,000 to ₹75,000. Additionally, the deduction on family pension for pensioners under the new tax regime is proposed to be increased from ₹15,000 to ₹25,000. The move is set to benefit around four crore salaried individuals and pensioners, leading to potential savings of up to ₹17,500.

Finance Minister Sitharaman said that more than two-thirds of individual taxpayers opted for the new personal income tax system in the last financial year, while more than 8.61 crore income tax returns were filed in the financial year 2023-24. The new tax slabs under the revised income tax system will be effective from April 1, 2024 and will be applicable for the assessment year 2025-26. Under the proposed changes, income up to Rs 3 lakh will continue to be exempt from income tax under the new system.

The new tax slabs are as follows:

5% tax on income between ₹3-7 lakh

10% tax on income between ₹7-10 lakh

15% tax on income between ₹10-12 lakh

20% tax on income between ₹12-15 lakh

30% tax on income above ₹15 lakh

Under the current tax regime, the tax slabs are as follows:

5% tax on income between ₹3-6 lakh

10% tax on income between ₹6-9 lakh

15% tax on income between ₹9-12 lakh

20% tax on income between ₹12-15 lakh

30% tax on income above ₹15 lakh

These amendments are aimed at simplifying the tax structure and making the new tax regime more attractive to taxpayers. The Government’s efforts to increase standard deduction and adjust tax slabs are expected to provide significant relief and encourage more individuals to adopt the new tax regime.

Minister Sitharaman emphasized that these measures are part of the Government’s ongoing commitment to improve the financial well-being of salaried employees and pensioners, while ensuring that the benefits of economic growth reach all sections of society.

Get The Latest News Of Himachal First On Mobile, Click Here To Join Our WhatsApp Group