Temasek’s Restructuring Moves It in the Right Direction

Temasek’s restructuring may be gradual, but it is a smart and timely step. With a portfolio valued at S$434 billion ($338 billion), the Singapore state investor is now organizing its holdings into roughly a 40-40-20 split: core strategic stakes in domestic companies such as DBS (DBSM.SI) and Singapore Airlines (SIAL.SI), its international investments, and its funds, partnerships, and asset management arms. The move responds to growing calls for greater transparency in the city-state’s sovereign wealth funds and could deliver additional benefits.

For CEO Dilhan Pillay, who took the helm in 2021, the timing makes sense. By March, Temasek’s 10-year total shareholder return slipped one percentage point to 5%, with longer-term performance also trending lower. Rising populism and protectionism globally create a challenging backdrop for capital deployment and value creation.

The changes aim to improve what lies within Pillay’s control. By appointing leaders to directly oversee Singapore holdings and global investments, he can empower them and link compensation more closely to results. That distinction matters: Temasek typically acts as a minority investor abroad, but takes controlling stakes in its domestic champions.

If carried through fully, the three units may eventually disclose their individual returns, complementing the aggregate figures Temasek reports today. Pillay has said the firm expects to publish more performance details over time, though it has not committed to a higher level of disclosure. Such transparency could help demonstrate how well its overseas investments are performing.

Temasek began in 1974 as a holding company for government-linked commercial businesses. Its domestic portfolio—banks, airlines, ports, and utilities—remains strategically important to Singapore’s role as a financial and trading hub, and is not up for sale. But while these holdings add resilience, they may drag on returns: the MSCI Singapore index delivered only two-thirds of the MSCI World index’s annualized returns over the past decade.

That may explain why Pillay also announced Temasek would abandon its traditionally light-touch approach to local investments. It will now appoint board members and encourage portfolio firms to pursue growth through acquisitions. That shift is already visible: in 2023, offshore marine company Seatrium (SEAT.SI) was created from a merger pushed by Temasek, and a year earlier it supported a rights issue that enabled aviation services firm SATS (SATS.SI) to acquire global cargo handler Worldwide Flight Services.

If Temasek continues to push forward on all these fronts, it would be a welcome development.

— Una Galani

Reference News

On August 28, Temasek announced an internal restructuring. The state investor said it would create three wholly owned subsidiaries—Temasek Global Investments, Temasek Singapore, and Temasek Partnership Solutions—to manage its three core segments. As of March, their portfolio shares were 36%, 41%, and 23% respectively. The change takes effect April 1, 2026.

Temasek said the restructuring is needed to drive growth and returns with greater accountability. By March, its portfolio value had risen 12%, largely due to gains in listed assets, though its 10-year total shareholder return slipped to 5%.

Pillay gave his first media interview since becoming CEO nearly four years ago to explain the changes.

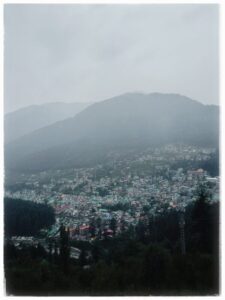

Continuing the achievement of the journey of effectiveness and credibility of more than 10 years in the career of journalism, as a woman journalist, I am Serving as the founder, promoter and editor of DiaryTimes with the trust and support of all. My credible coverage may not have given a big shape to the numbers, but my journey presents articles that make you aware of the exact and meaningful situations of Himachal’s politics, ground issues related to the public, business, tourism and the difficult geographical conditions of the state and financial awareness. DiaryTimes, full of the experience of my precise editorial expertise, is awakening the flame of credible journalism among all of you, so that the eternal flame of meaningful change can be lit in the life of the people of the state and the atrocities being committed against the people can be brought to the fore, I am motivated for that. If even a small change comes with the power of my journalism and the whole world becomes a witness to that issues, then I will consider myself fortunate.