News

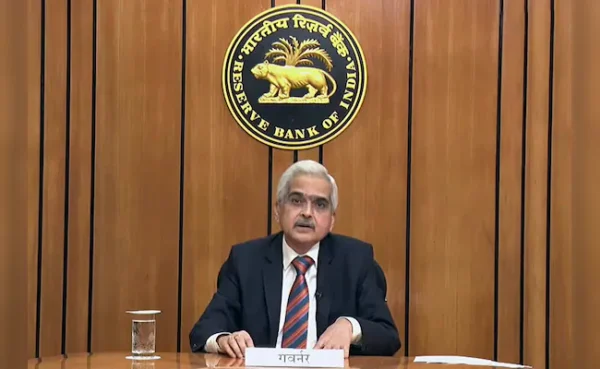

Kangra Central Cooperative Penalised ₹25 Lakh for Violating RBI Banking License Conditions

In a significant regulatory move, the Reserve Bank of India (RBI) has imposed a penalty of ₹25 lakh on Kangra Central Cooperative Bank for non-compliance with the conditions attached to its banking license. The penalty stems from the lender’s violation of operational guidelines, specifically concerning the extension of loans outside its designated area of operation.

The RBI’s action highlights the importance of adhering to the conditions set forth when granting banking licenses, which are designed to ensure the safety and soundness of the financial system. According to the RBI, Kangra Central Cooperative Bank had extended loans beyond the geographical boundaries specified in its license, thereby breaching regulatory norms.

The bank’s deviation was identified during routine supervisory inspections, which revealed discrepancies in its lending practices. The RBI’s notice stated that the bank had not ensured proper compliance with the licensing conditions, which could potentially pose risks to the financial stability of the institution and the broader banking ecosystem.

While the bank has been penalized, the RBI clarified that the penalty was not intended to affect the bank’s financial stability but to reinforce the importance of regulatory compliance. “The penalty has been imposed for non-compliance with regulatory requirements, and it serves as a reminder for all financial institutions to adhere strictly to the conditions of their licenses,” the RBI spokesperson stated.

Kangra Central Cooperative Bank, a key regional lender in Himachal Pradesh, has a significant presence in the local banking landscape, offering financial services to a large customer base. The bank’s management has acknowledged the penalty and assured that corrective measures are being implemented to align its operations with RBI guidelines.

In response to the penalty, the bank’s spokesperson said, “We recognize the importance of regulatory compliance and are committed to rectifying the identified issues. We have already initiated internal reviews and strengthened our compliance framework to prevent such occurrences in the future.”

The RBI continues to emphasize its commitment to maintaining the integrity and stability of the banking sector. It regularly conducts inspections and audits to ensure that banks operate within the legal and regulatory framework, thereby safeguarding the interests of depositors and the financial system at large.

As the financial sector evolves, this incident underscores the critical role of regulatory oversight in maintaining trust and accountability within the banking system.