Business News

RBI Governor warns, rise of AI can pose a threat to financial stability

Financial service providers are using AI to improve customer experience, reduce costs, manage risk and boost growth through chatbots and personal banking.

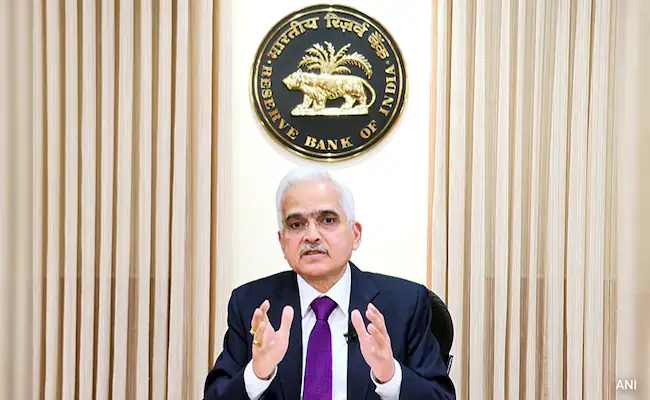

Mumbai: The growing use of artificial intelligence and machine learning in financial services globally can pose financial stability risks and adequate measures should be taken by banks to mitigate the risk, the Reserve Bank of India governor said on Monday.

“Excessive reliance on AI can lead to concentration risks, especially when the market is dominated by a small number of technology providers,” Shaktikanta Das said at an event in New Delhi.

This can increase systemic risks as failures or disruptions in these systems can spread across the financial sector, Das said.

India’s financial service providers are using AI to improve customer experience, reduce costs, manage risk and boost growth through chatbots and personal banking.

Das said the growing use of AI introduces new vulnerabilities, such as increased susceptibility to cyber attacks and data breaches.

He warned that the “opacity” of AI makes it difficult to audit and interpret the algorithms that drive lender decisions and could potentially lead to “unpredictable outcomes in the market.”

Furthermore, Das said private credit markets with limited regulation have expanded rapidly around the world, posing significant risks to financial stability, especially when these markets have not been stress-tested during recessions.